connecticut sports betting tax rate

Connecticut regulators are racing to get a sports-wagering operation in place in time for the lucrative football season. Ned Lamont and launched six months later on Oct.

Connecticut Reports 16 Million In Sports Betting Revenue In First Full Month

Sports betting licenses are good for 10 years.

. A 1375 tax rate on sports wagering and an 18 tax. The companies will also pay a 1375 percent tax on sports and fantasy sports betting. Reportable for federal tax purposes OR.

Tax rate on sportsbook operators. Sports betting tax rate. The total amount owed for taxes on gambling winnings depends on the total amount earned by.

The bill passed by state legislators ratified the details of the new gaming compact between tribes and the state. Regulation of Online Casino Gaming Retail and Online Sports Wagering Fantasy Contests Keno and Online Sales of Lottery. This is in line with the national trends where the majority of states have opted for lower rates.

31 rows Since the inception of legal sports betting in 2018 the Garden State has collected 1695. There would be a 1375 percent tax rate on sports wagering. 12000 and the winner is filing separately.

A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. 10 on net sports betting proceeds. Handle Revenue Hold Taxes.

If youre a working american citizen you most likely have to pay your taxes. The legislation is Public Act 21-23. An effective tax rate of 36 and a 10 million licensing fee.

The exceptions to the rule are Delaware New Hampshire and Rhode Island which all have rates around 50 percent and Pennsylvania with a 34 percent rate. Beranda Connecticut Sports Betting Tax Rate. State law in Connecticut requires prize grantors to withhold 699 on all gambling winnings that are either.

Connecticut sports betting apps pay a 1375 revenue tax. The lowest rate is 2 whereas the highest is just under 6 at 575. The sports betting tax rate for CT is 1375 Connecticut lottery can take up to 15 retail sportsbooks Bettors cannot place wagers on Connecticut college sports teams.

In Maryland there is a gambling winnings tax rate of 875. Proceeds will go to a college fund to allow students to attend Community College for free and also to fund some smaller municipalities in the state. Connecticut online sports betting took a major step forward this week after gaming bills advanced to the states House of Representatives.

19 2021 after a weeklong. Both sports betting and online gambling would be limited to those 21 and older. Three online brands were authorized.

Thats the expected amount that will be owed when it comes tax time each year but that doesnt mean its the amount that is actually owed. Connecticut Legal Online Sports Betting Tax Rate. Subject to federal withholding tax.

Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. 32 rows How States Tax Sports Betting Winnings. Osten co-chair of the Appropriations Committee told CT Examiner that legislators expect about 80 million in additional revenue for the state from all new forms of gambling.

Since the legal sports betting expansion in 2018 the amount of sports betting revenue has increased dramatically. Sports betting taxes are almost always levied as a percentage of the value of the adjusted. The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person.

Connecticut sports betting totals Connecticut market snapshot. This does not explicitly state sports betting but it. A 1375 percent tax rate on sports wagering.

Both the tribes and the Connecticut Lottery will pay the tax. The standard amount withheld by sportsbooks to cover sports betting taxes on wins is 24. The Law Regulations and Technical Standards for all forms of Online Gaming.

Connecticut Lottery shall have the right to sublicense locations to the state-licensed parimutuel operator. The deal also calls for a separate 1375 tax rate on sports betting. The sports betting area of Twin River Casino in Lincoln RI in a 2019 file photo.

19000 and the winner is filing head of household. The Connecticut General Assembly has more information available about the underlying bill House Bill 6451. Online sports betting in Connecticut launched Oct.

Sports betting online gambling and taxes. This law applies to all CT Lottery. 24 Tax Withheld.

Connecticut state taxes for gambling. A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on new online commercial casino gaming would go into effect followed by a 20 tax rate for at least the next five. This rate applies equally to both the tribes and the lottery though the latter is apparently seeking to.

CT sports betting law. 19 but getting to that point was sometimes a painstaking process. 13000 and the winner is filing single.

Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. 24000 and the winner is filing. Connecticut Sports Betting Tax Rate Desember 02 2021 Posting Komentar As an employee you are surprised to see that your paycheck is well below what you might expect from the monthly salary agreed to with your employer.

Sports betting revenue receives a tax rate of 1375. The Nutmeg State legalized sports wagering on May 19 2021 by Gov.

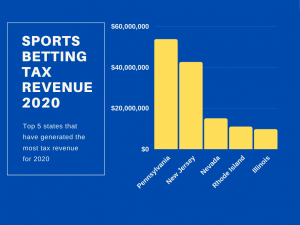

Sports Betting Tax Revenue By State Top 5 Earners Odds Com

Connecticut Sports Betting Apps Top Legal Sportsbooks In Ct Miami Herald

New Jersey Gambling Revenue America S 1 Sports Betting Market

Sports Betting Tax Revenue By State Top 5 Earners Odds Com

Governor Ned Lamont On Twitter In May I Signed A Bill That Legalized Online Sports Betting And Igaming A Huge Modernization Effort For Ct By October Retail Sports Betting Was Up

As Sports Betting Takes Off Connecticut Doesn T Require Betting Operators To Share Problem Gambling Data Connecticut Public

Connecticut Online Sports Betting News And Promos

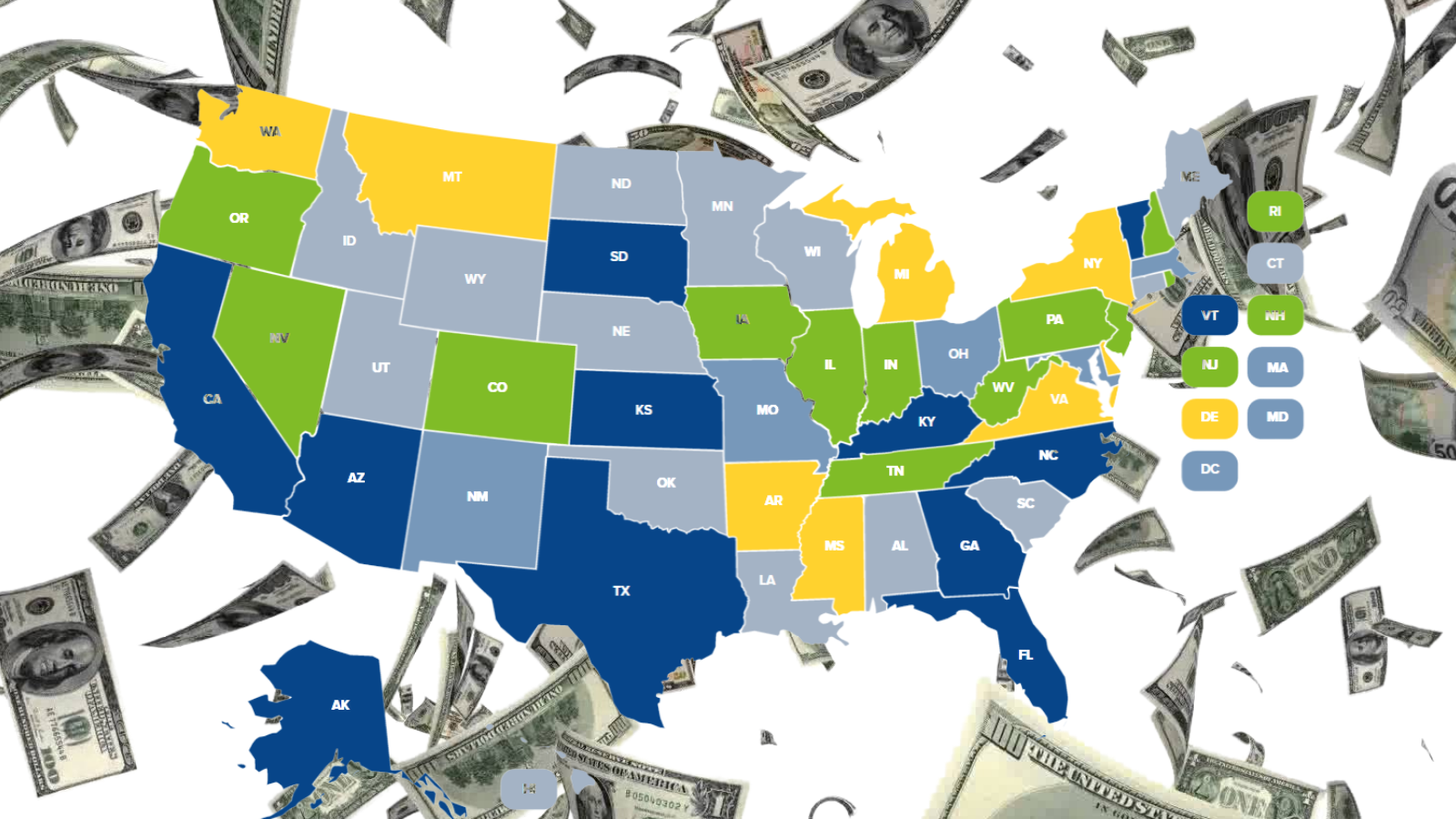

How To Map Out The Multi Billion Dollar U S Online Market Vixio

Arizona Sports Betting Top Sportsbook Sites July 2022

Connecticut Sports Betting Apps Top Legal Sportsbooks In Ct Miami Herald

Puerto Rico Legal Sports Betting On The Horizon

Connecticut Reports 16 Million In Sports Betting Revenue In First Full Month

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/IEAYBNYQ3EEMAJ2EFQUUF2WBYQ.aspx)

Sports Betting Will Begin Early In Nfl Season After Connecticut Lottery Picks Vendors To Run Online Gambling And Sports Betting Venues Hartford Courant

Sports Betting Operators Post National Record Monthly Revenue Totals In November Gaming Law Review

How To Map Out The Multi Billion Dollar U S Online Market Vixio

Connecticut Sports Betting Apps Top Legal Sportsbooks In Ct Miami Herald

Sports Betting Operators Post National Record Monthly Revenue Totals In November Gaming Law Review

Massachusetts Senate Passes Sports Betting Bill News Berkshireeagle Com